Home Buyer Program

Macomb Habitat’s homeownership program is all about partnership. We commit to building safe, decent homes and selling them to qualified low-income families via a 25-year mortgage. Our Home Buyer’s program is designed to assist first-time prospective homeowners achieve the American dream of homeownership.

Habitat offers the necessary homebuyer education to make sure partner families are ready for long-term, successful homeownership. In addition to a down payment and monthly mortgage payments, homeowners invest sweat equity hours building their future Habitat home and the homes of other Habitat Homebuyers.

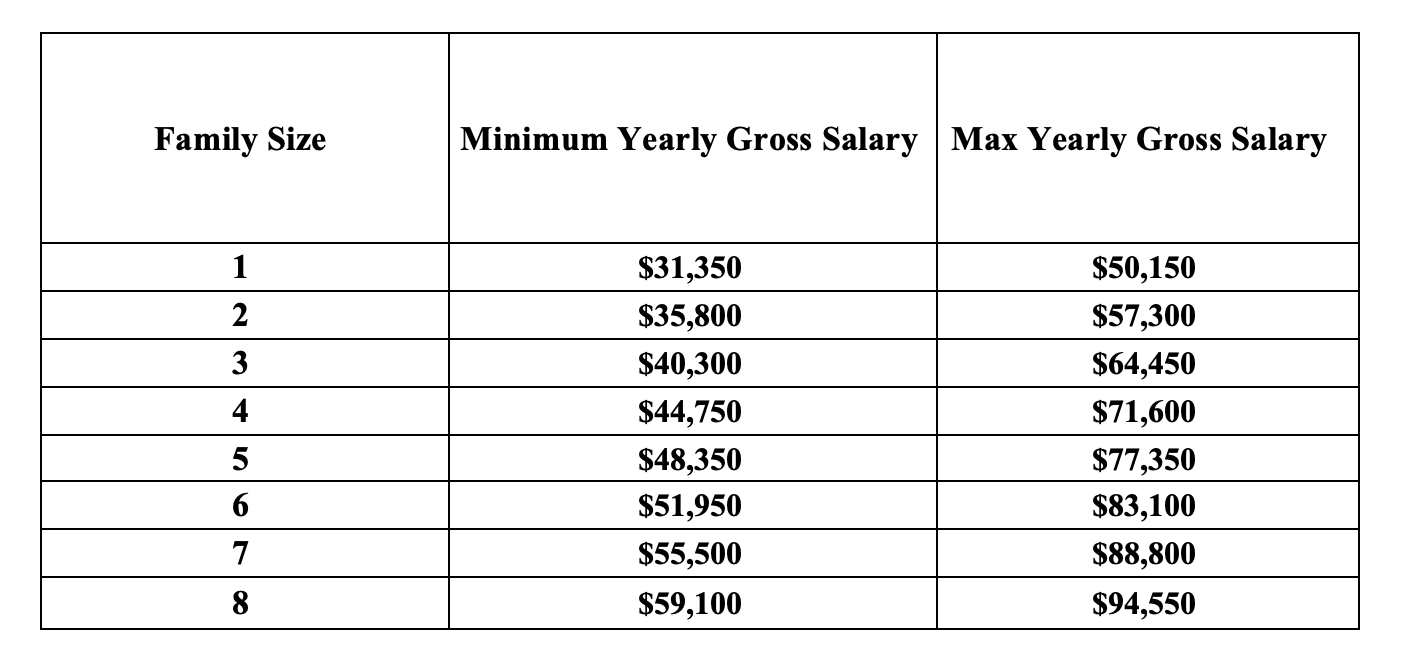

Check out our Homeownership Qualifications below to find out what families can do to partner with Habitat. Interested applicants must submit an application and meet the following program eligibility requirements.